Voluntary Benefits

Accident, Critical Illness, Hospital Indemnity, Home & Auto, and Pet coverage are available to you, your spouse, and your dependent children. However, employees must have coverage in order for their spouse and children to obtain coverage.

Voluntary Benefits are just that, voluntary. The costs for voluntary benefits are 100% paid by the employee. You can get a custom quote from the respective providers.

Accidental, Critical Illness & Hospital Indemnity

With Accident, Critical Illness, and Hospital Indemnity Insurance from MetLife, you can help prepare for unexpected expenses. For example, consider medical costs that may not be covered in full by your existing plan, like co-pays, deductibles, and physical therapy, as well as costs you may not think of, like transportation to doctors’ appointments or additional childcare expenses. These unexpected costs can cut into your budget and make managing everyday expenses a challenge.

To learn more about the MetLife Accidental, Critical Illness and Hospitality supplemental insurance click the image below to view the PDF file.

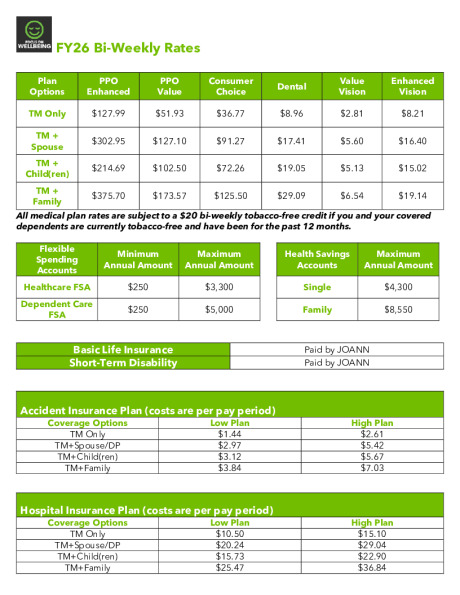

Accident Insurance

Critical Illness Insurance

Hospital Indemnity Coverage

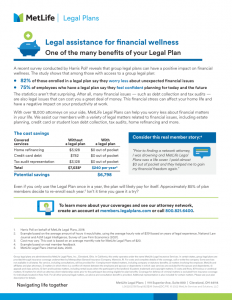

MetLife Legal Plans

With over 18,000 attorneys on your side, MetLife Legal Plans can help you worry less about financial matters in your life. We assist our members with a variety of legal matters related to financial issues, including estate planning, credit card or student loan debt collection, tax audits, home refinancing and more.

Pet Insurance

Our dogs and cats make each day brighter. That’s why now, more than ever, keeping them safe and healthy is important.

With MetLife Pet Insurance, you can help take the worry out of covering the cost of unexpected pet care. You may be able to cover up to 100% on veterinary expenses at any licensed veterinarian, specialist or emergency clinic in the U.S.

To learn more about the MetLife Pet Insurance click image below to view the PDF file.